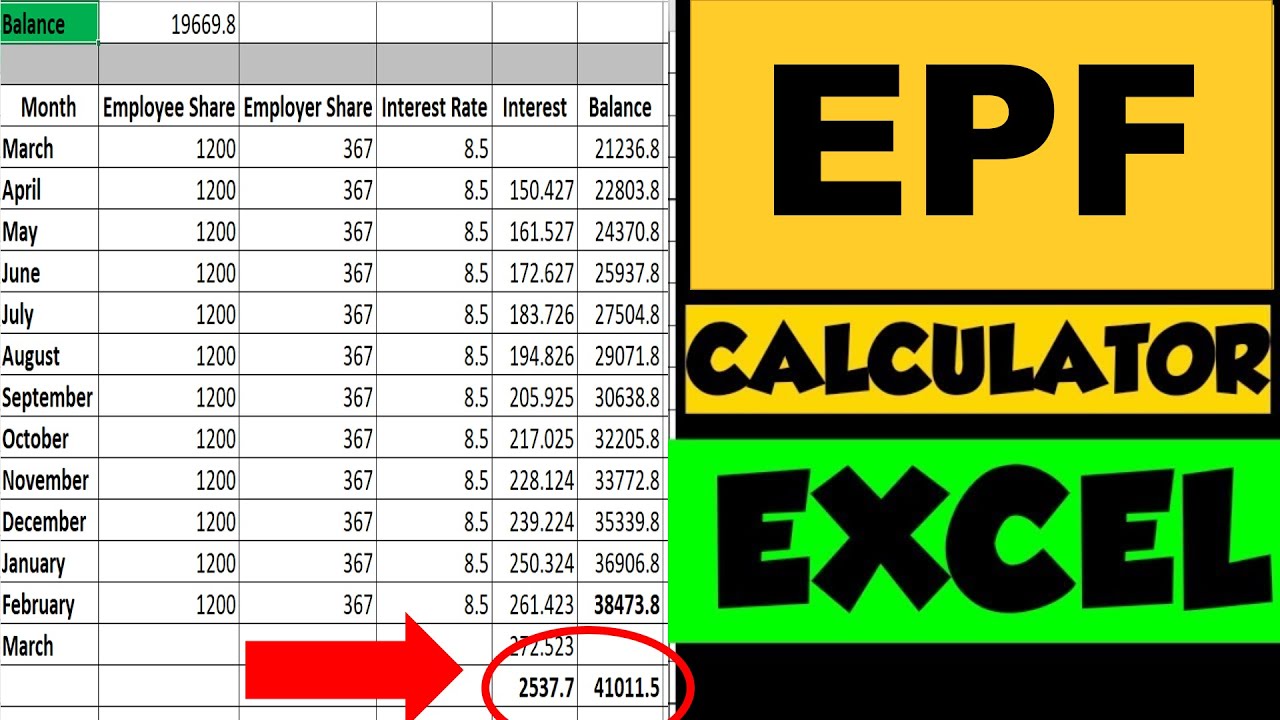

Interest on the EPF contribution for April Nil No interest for the first month Interest on the EPF contribution for May 4700 0675 31725. An example of an Epf Calculator is as follows.

Best Free Home Loan Calculator Stamp Duty Legal Fees Included

05 percent of the employees monthly earnings.

. And make monthly withdrawal of an amount that you will need. Key in the Monthly Regular Contribution amount for your KWSPEPF account. Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April.

7 minutes Editors note. The saving is comprised of the employees and employers monthly contributions and yearly. So youve read our Introduction to Monthly Tax Deductions MTDPCB and have an understanding of what it is why it exists whether you need to file it and how it works.

While in savings these funds may be used in. I-akaun member i-akaun employer i-akaun business partners. KWSPEPF average yearly interest rate is around 55 per annum so key in 55.

In the case of employees receiving wagessalaries of RM5000 and lower the share of the employees contribution is 11 percent of their monthly pay with the employer contributing the remaining 13 percent of their monthly salary. Mobile team near you. The Employees Provident Fund Board will remit the dividend payout to members accounts on March 6 when CPF members can check their deposits and the interest earned.

Register your employees as EPF members and keep their information updated. Register with the EPF as an employer within 7 days upon hiring the first employee. If you do need to file it then you must.

If you save RM50000 each month key in RM50000 Key in the expected KWPSEPF Interest Rate Per Annum This is the yearly interest rate of your KWSPEPF for example. How is socso Malaysia calculated. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers.

The EPF functions through monthly contributions from employees and their employers towards saving accounts. Calculate your salary EPF PCB and other income tax amounts online with this free calculator. PCB calculator Tax calculator EPF Payroll Sosco and EIS.

The Malaysian Employees Provident Fund Board KWSP has announced a dividend payout rate of 610 for conventional CPF accounts and 565 for Islamic CPF accounts. How is EPF interest calculated. Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022.

The interest rate for fiscal year 2019-20 is 85 percent. After starting with a small membership of little more than 500000 members in 1952 the EPF currently has more than 14 million members with total contributions surpassing RM800 billion and total assets under administration creeping closer to a trillion ringgit. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Overview The EPF Employees Provident Fund is a Malaysian government agency that manages a compulsory savings plan and retirement planning for private and non-pensionable public sector employees. How is EPF calculated manually. Calculate your EPF PCB online with this free tool.

How Do I Calculate PCBMTD Part 2 of 3 was uploaded on 12 June 2020 and recently updated on 25 May 2021. Inflation rate is at default 3 per annum. EPF keep Malaysia employees salary percentage which familiar known as 11 some 7 with the new laws and regulations while employers contribute 13 of the employee salary.

Life time EPF savings average at default 4 dividend rate per annum. EPF is a retirement saving scheme for employees who are liable to contribute EPF in Malaysia governed under the Employee Provident Fund Act 1991 in which the savings contributed will be managed and invested under Simpanan Konvensional or Simpanan Shariah. Upon retirement you will keep your savings invested with 4 default rate of return pa.

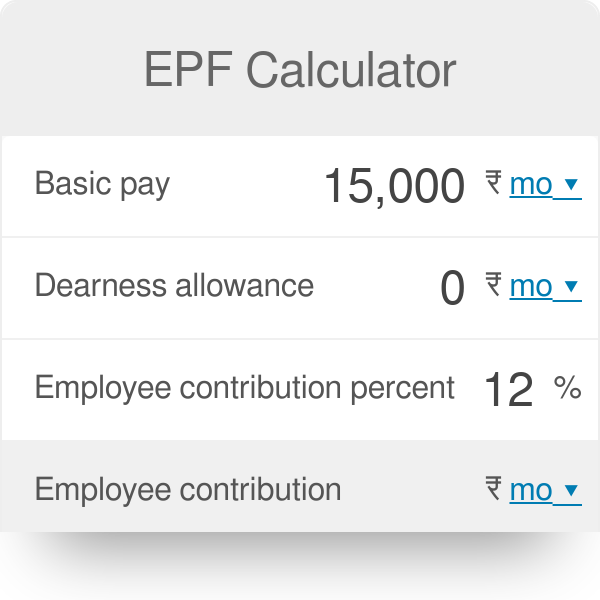

The EPF contribution is credited to the EPF account on a monthly basis and interest is calculated on a monthly basis as well as the contribution. Collect your employees share of EPF contribution and submit it to the EPF along with the employers share. After entering the requisite information the EPF calculator will show you the EPF funds available at retirement.

The EPF calculator has a formula box where you enter your current age your basic monthly salary and the dearness allowance your contribution to the EPF and your retirement age up to 58 years. How is EPF calculated in Malaysia. You can also enter the current EPF balance if you know the figures.

Both of the amount of 11 from the employee and 13 from the employer add up together and store 70 into personal EPF account 1 while another 30 store into personal EPF. The Retirement Calculator should be used as a guide and not as a guarantee of. The total interest earned for the year on the other hand will be credited at the conclusion of the fiscal year.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Provide salary statements to employees.

Salary Formula Calculate Salary Calculator Excel Template

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Epf Calculator Employees Provident Fund

Confluence Mobile Support Wiki

How To Calculate Your Epf 2010 Msia Hr News

Salary Calculator Career Resources

Can You Calculate This Simple Salary Calculation Correctly Actpay Payroll

Kwsp Calculator Apps On Google Play

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Confluence Mobile Support Wiki

Confluence Mobile Support Wiki

How Epf Interest Is Calculated All You Need To Know Businesstoday

Indonesia Payroll What Are The Methods To Calculate Pph21 How It Is Applicable In Deskera People

Epf Calculator Employee Provident Fund Epf Calculator

Salary Formula Calculate Salary Calculator Excel Template

Epf Excel Calculator Employee Provident Fund How To Calculate Epf Interest With Epf Interest Rate Youtube